There’s an interesting analysis in the Daily Telegraph of how the money people pay in income tax and national insurance is spent. You can find it here.

To put things in context, average annual earnings of those working? in our district are about ?22,000.

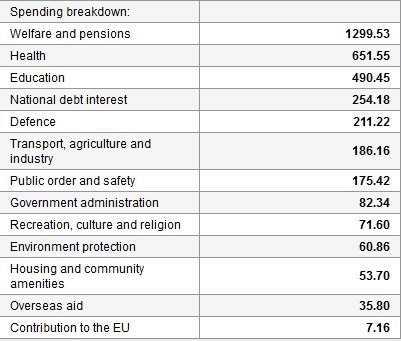

If you earn??20,000 per year you pay Income tax of ? 3110.20 and National Insurance of 2069.76 – a total of ?5179.96.? According to the Telegraph report? that is spent as follows:

If you are doing better and earning ?50,000 per year you are paying this much:

And what’s included in the big amount for “Welfare and Pensions?” According to the Guardian earlier this year , the biggest chunk of that goes on pensions:

47% of UK benefit spending goes on state pensions of ?74.22bn a year …. It’s followed by housing benefit of ?16.94bn …. and Disability living allowance of ?12.57bn . ….Jobseekers’ allowance is actually one of the smaller benefits – ?4.91bn in 2011-12….

Our contribution to the EU is probably a lot lower than most people would expect.